1031 Exchange Financing

If you own an investment property and are considering selling it, a 1031 exchange is a way to avoid getting taxed on your capital gains. A 1031 exchange or 1031 tax-deferred exchange allows the owner of an investment property to sell it and buy like-kind property while deferring capital gains tax. Read more below to understand how a 1031 exchange works and the guidelines.

If you are approaching the 180 day deadline to close escrow on your new property then a bridge loan may be a good option to consider. To learn more about 1031 exchanges and how bridge loans can help you close your real estate transaction quickly please read below.

Apply for a Bridge Loan

Get started by completing the form below and an associate will reach out to get your loan details

What is a 1031 Exchange?

A 1031 Exchange is an IRS approved process where like-kind business or investment properties are exchanged without immediate tax liability to the property owner. The IRS has set out strict time deadlines for 1031 exchanges – no exceptions:

- You are required to complete the exchange within 180 days.

- You must provide the IRS with 3 property purchase options within 45 days of beginning the exchange process to determine eligibility.

- Once eligibility is determined, you can proceed with purchasing the property, mindful of the 180 day timeline.

Given the strict time deadlines associated with 1031 exchanges, obtaining a bridge loan from a hard money lender can be a way to close quickly on a property to ensure closing before the exchange deadline. Bridge lenders typically close loans in a few weeks as opposed to traditional lending institutions that could take up to a few months. Wilshire Quinn funds loan in 5-7 days. Hard money lenders give you the flexibility to close deals fast, allowing you to manage your exchange deadline time with less stress.

Who qualifies for a 1031 Exchange?

According to the IRS, owners of investment and business properties may qualify for a Section 1031 deferral. Individuals, C corporations, S corporations, partnerships (general or limited), limited liability companies, trusts and any other taxpaying entity may set up an exchange of business or investment properties for business or investment properties under Section 1031.

What qualifies the property for a 1031 Exchange?

The property being sold and the replacement property(ies) must meet certain requirements to be eligible for a 1031 exchange.

- Primary residence not eligible. The properties must be for business purpose or investment properties. A primary residence or vacation home is not eligible.

- The properties must be “like-kind” or similar. Most real estate will be considered like-kind to other real estate. Quality is not a consideration. It can even be a building being replaced by vacant land. An exception to this is property outside the United States.

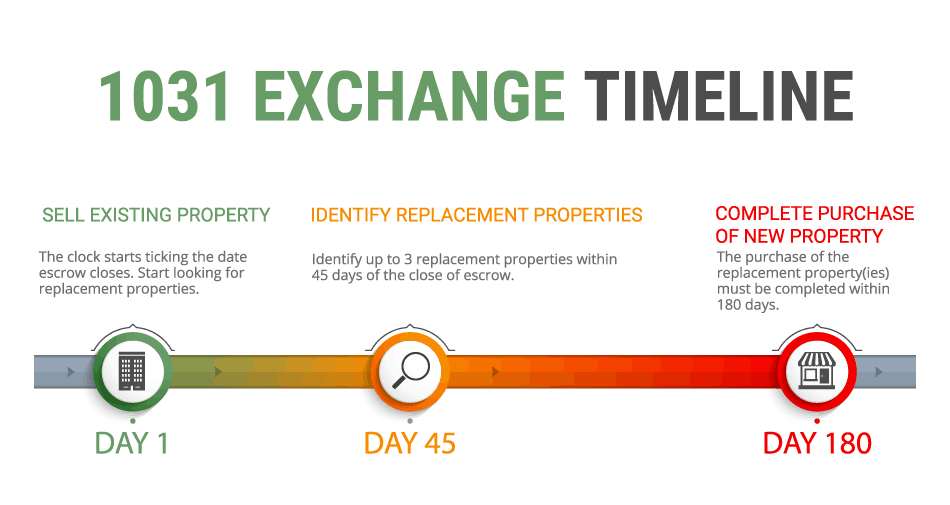

Timeline for a 1031 Exchange

A 1031 Exchange does not have to be done simultaneously, but it does have to meet 2 very strict time limits. The fist limit is 45 days from the start. The clock starts on your timeline the day escrow closes on the sale of your property. You must identify potential replacement properties within these 45 days. The replacement properties must be identified clearly in written correspondence. This includes a legal description, street address or distinguishable name.

The second time limit is the 180 day limit. The replacement property must be received and the exchange completed no later than 180 days after the sale of the exchanged property or the due date (with extensions) of the income tax return for the tax year in which the relinquished property was sold, whichever is earlier.

Benefits of a 1031 Exchange

Example #1 – Cash Out

Brad is the owner of a 5 unit apartment complex in San Diego, CA. He bought the investment property 20 years ago for $1,000,000, putting $250,000 down and financing $750,000. Now the property is worth $2,000,000. Given that the property has increased in value 2 times its worth 20 years ago, Brad decides he wants to sell the property. He still owes $500,000 on his mortgage and will pay a tax rate of 30%.

Original Purchase 20 years ago

| Original Mortgage | $750,000 |

| Original Cash Down | $250,000 |

| Original Purchase Price | $1,000,000 |

Theoretical Sale Today

| Sales Price | $2,000,000 |

| Mortgage Payoff | ($500,000) |

| Net Proceeds | $1,500,000 |

| Capital Gains | $1,000,000 |

| Approximate All-In Tax Rate | 30% |

| Approximate Tax Bill | ($300,000) |

Example #2 – Brad does a 1031 Exchange

1031 Financing Summary

| Net Proceeds From Sale | $1,500,000 |

| Purchase Price of New Property | ($2,000,000) |

| Required Mortgage Amount | $500,000 |

Brad gets a bridge loan to finance the additional $500,000 to defer 100% of the capital gains tax.

| New Mortgage | $500,000 |

| Defered Taxes | $300,0000 |

Bridge loans are typically funded within 5-7 days. Brad was able to use a bridge loan to purchase the replacement property within the 180 deadline and time to spare. By using a 1031 exchange to reinvest into a new property, he was able to defer taxation of $300,000 on his capital gains. A bridge loan assisted him in completing the transaction on-time without coming out of pocket.

* The information provided here is not meant to be considered as tax advice or legal advice, but for general discussion purposes only. Please do not rely on this information as authoritative. Please consult your attorney or tax professional for specific advice.

1031 Exchange Financing

Many investors use a bridge loan to successfully navigate through a 1031 exchange on-time.

If you are in the process of a 1031 Exchange and are running out of time, call us today to get a pre-approval. We can fund in as little as 5 days to help you close on your replacement property on-time. Borrow up to $20M for commercial & residential real estate.

Here’s What Our Borrowers Are Saying

A Proven 1031 Exchange Bridge Loan Lender, Lending Nationwide

Recently Funded Hard Money Loans

LOS ANGELES, CA

Loan Amount: $16,025,000

Loan Type: Blanket Refinance

Property Type: Hospitality

Loan-To-Value: 43%

Term: 12 Months

DENVER, CO

Loan Amount: $2,520,000

Loan Type: Purchase

Property Type: Assisted Living

Loan-To-Value: 59%

Term: 12 Months

LOS ANGELES, CA

Loan Amount: $10,675,000

Loan Type: Refinance

Property Type: Parking Structure/Retail

Loan-To-Value: 52%

Term: 12 Months

LAKE OSWEGO, OR

Loan Amount: $1,500,000

Loan Type: Purchase (Blanket)

Property Type: Single-Family

Loan-To-Value: 61%

Term: 12 Months

Submit a loan application

Partner with a direct lender you can trust.

FAQs – 1031 Exchange (Like-Kind Exchanges) – IRS Guidelines

Real estate investors who own investment and business property may qualify for a Section 1031 exchange. The 1031 exchange guidelines pertain to Individuals, C corporations, S corporations, partnerships (general or limited), limited liability companies, and trusts.

With a Section 1031 exchange, there must be an exchange of properties. The simplest type of Section 1031 exchange is a simultaneous swap of one property for another. A real estate owner will sell one business or investment property and use the proceeds of the sale to purchase another similar property within the required timeline established by the IRS.

Both the property that you sell and the new property you purchase must meet certain requirements. Both properties must be used for business or for investment. Property used primarily for personal use, like a primary residence or vacation home, do not qualify for a 1031 exchange. Both properties must qualify as “like-kind.” Like-kind property is property of the same nature, character or class. Most real estate properties are considered to be like-kind to other real estate. For example, if an investor sells a 4-unit home and purchases a large apartment building, those properties are still considered like-kind as both properties are classified as investment real estate. Land may also be considered “like-kind” with other real estate property types such as apartment buildings and SFRs.

While a like-kind exchange does not have to be a simultaneous swap of properties, you must meet two time limits or the entire gain will be taxable. These limits cannot be extended for any circumstance or hardship except in the case of presidentially declared disasters.

The first limit

You have 45 days from the date you sell the relinquished property to identify potential replacement properties. The identification must be in writing, signed by you and delivered to a person involved in the exchange like the seller of the replacement property or the qualified intermediary. However, notice to your attorney, real estate agent, accountant or similar persons acting as your agent is not sufficient.

Replacement properties must be clearly described in the written identification. In the case of real estate, this means a legal description, street address or distinguishable name. Follow the IRS guidelines for the maximum number and value of properties that can be identified.

The second limit

The replacement property must be received and the exchange completed no later than 180 days after the sale of the exchanged property or the due date (with extensions) of the income tax return for the tax year in which the relinquished property was sold, whichever is earlier. The replacement property received must be substantially the same as property identified within the 45-day limit described above.