Long Beach

Hard Money Lender

We are a Long Beach hard money lender financing commercial and residential real estate loans up to $10M. Being a direct hard money lender allows us to pre-approve our borrowers in 24 hours and fund the loan in about 5-7 days. Whether it is a purchase, refinance, cash out, or a multiple property loan; you can count on Long Beach hard money lender, Wilshire Quinn.

619.872.6000 | loans@wilshirequinn.com

Apply for a Hard Money Loan

Get started by completing the form below and an associate will reach out to get your loan details

To Speak With A Representative

Call (619)872-6000

What is a Hard Money Loan?

A hard money loan is a short-term loan also known as a bridge loan, that is used until a person or company either secures permanent financing or removes the obligation through the sale of the property. Hard money loans generally have higher interest rates than conventional or bank loans, and are written for shorter periods of time. Typical hard money loans or bridge loans are 12 to 18 months in length. Wilshire Quinn loans do not exceed 60% of the appraised value of the property securing the loan.

Who Typically Uses a Hard Money Loan

- Business owners looking to pull cash out of existing properties

- People who want to close quickly

- Borrowers who have multiple properties looking to cross collateralize

- Investors looking to purchase rental properties

- Investors who buy, repair, and immediately resell their property (Flippers)

- Borrowers who cannot refinance with a traditional bank

- Builders and more…

Long Beach Hard Money Lender – financing your residential and commercial real estate investments

Long Beach is the 36th most populous city in the US and the second largest city in the Los Angeles metropolitan area. The port of Long Beach is among the worlds largest shipping ports.

According to Trulia, the median home value in Long Beach is $525,000. Long Beach home values have gone up 8% over the past year. The average price of a home in the United States, on the other hand, is just over $200,000. Long Beach real estate is considered a luxury market, and although it is not as expensive as the Bay Area market, it is still well above most of America. Home prices in Long Beach over the past few years have consistently risen making it worth consideration when looking at buying an investment property.

Looking to buy an investment property to rent out? Here’s why you should consider working with a Long Beach hard money lender

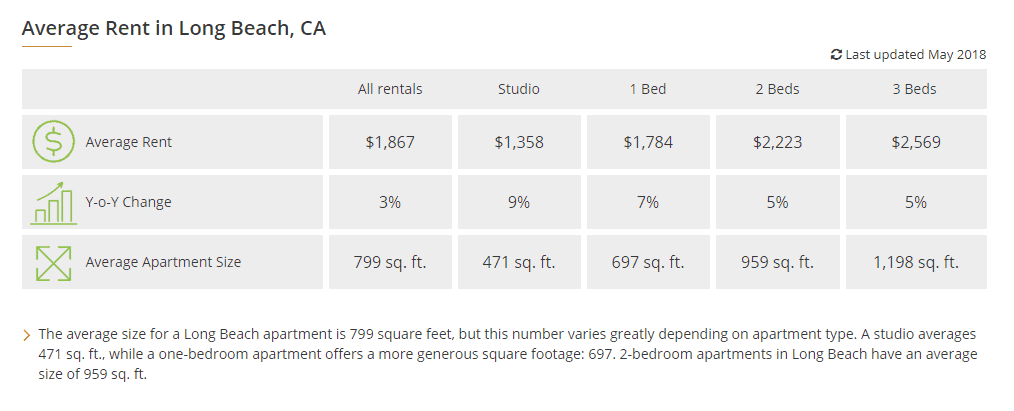

The cost of living in Long Beach has continued to increase over the past 10 years making home ownership difficult for people. Many Americans desire the single-family home lifestyle but just cannot afford to buy into it. Also, Millenials are delaying getting married and have massive school debt, and are not buying real estate. The number of Americans renting is incredibly high, leaving a great investment opportunity in rental income properties.

- the majority of Californians rent rather than owning, making purchasing a rental property a good business

- Homes with 2-3 bedrooms are the easiest to rent

- The average family size in Long Beach is 2.78

- The median rent per month in Long Beach is $2,695

Rental properties have recently created a stable vehicle for investing money and creating wealth. As many look to purchase an investment rental property, some look for a Long Beach hard money lender to finance their real estate purchase. Unlike traditional lenders, private money lending institutions focus more upon on the equity in a property relative to the borrower’s credit score. The underwriting and funding process can take place in a matter of days instead of weeks or months. Wilshire Quinn continues to fund hard money loans in Long Beach and across the nation.

Asset Based Lending

Asset based lending means we base our loan amounts on the value of real estate, such as an investment property, multifamily building, or commercial building, rather than strictly on your credit score and debt to income levels. Wilshire Quinn takes pride in our common sense equity based lending. Wilshire Quinn is a Long Beach hard money lender, with experience lending nationwide. As an experienced hard money lender we can handle even the most complicated of lending scenarios and care more about the real estate that you are purchasing or refinancing than inflexible bank requirements.

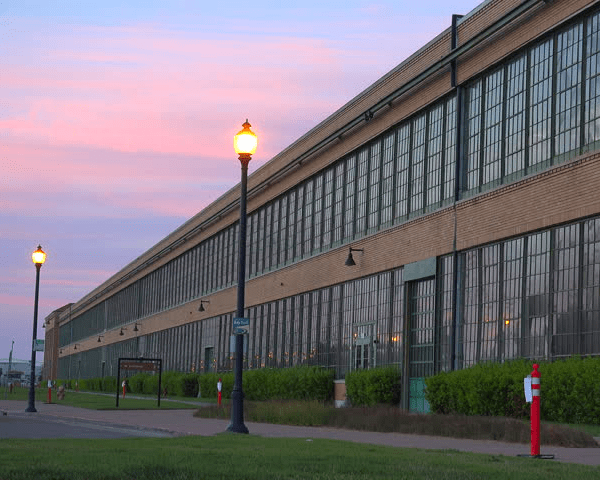

Long Beach Hard Money Loans for Industrial Space

The Port of Long Beach is the second busiest container port in the United States and is among the world’s largest shipping ports. With e-commerce on the rise in America, many are looking for industrial space to use as distribution centers. Imports from Asia are also growing making Long Beach a prime market for industrial buildings.

“When you think of industrial space, you have manufacturing space and distribution spaces, and when you think about all the distribution warehouses that are being used for e-commerce, it’s a real growth area,” Allen Matkins Operating Partner John Tipton said.

Our Borrowers Appreciate Us!

Premier Long Beach Hard Money Lender, Lending Nationwide

F.A.Q’s – Hard Money Loans 101

A hard money loan is a real estate-backed loan where a borrower receives funds secured by equity in their property (or properties). Hard money lenders like Wilshire Quinn are mainly focused on the equity in the property as opposed to borrower credit and financials. Hard money loans are typically short-term ranging from six months up to two years.

Hard money lenders like Wilshire Quinn primarily focus on a property’s equity to secure the loan. The borrower’s credit is considered, but is not a primary determinant in the underwriting process.

After receiving a signed term sheet, Wilshire Quinn typically funds a loan in five to seven business days.

Wilshire Quinn will consider a wide variety of property types including: office, retail centers, industrial, hotels, parking lots/structures, condo inventory, multifamily properties, non-owner-occupied single-family homes, vacation homes and rentals, primer loans and bridge loans.

We will consider a wide variety of loan types including: purchase, refinance, cash-out refinance, partnership buyouts, rehabs, 1031 exchanges and value-added acquisitions.

You can either complete our online loan application, email or call us. We would prefer to talk through your loan scenario directly, as we can determine in a matter of minutes, once we have a few simple questions answered, if we have interest.

Our interest rates typically range from 9% to 12%, interest-only. Lender origination points typically range from 1% to 5% of the loan amount. The borrower pays for standard closing costs (title, escrow, legal).

Most of our portfolio is in California but we do have the ability to lend nationwide. We strongly prefer to lend in major-metropolitan areas.

A Trusted Long Beach Hard Money Lender

Ready to Finance a Real Estate Investment?

At Wilshire Quinn we control the lending process and can provide fast answers and quick closings for your hard money lending needs. We are a direct lender which means we can fund hard money loans fast. We lend private hard money loans in Long Beach up to $10M with funding available in about 5-7 days.

Streamlined Process & Approval within 24 hours

Funding typically in 5-7 days

We are a Direct Lender; not a broker

Foreign nationals – OK

Refinance, purchase, blanket, refinance, rehab loans

Commercial, residential, multifamily, most property types considered

Special use buildings like: car wash, gym, parking lot, assisted living facilities, mobile home park.

Call us now at 619.872.6000 and speak directly to a decision maker. Get a pre-approval from a Long Beach hard money lender within 24 hours and funding in about 5-7 days.

Wilshire Quinn Capital, Inc.

2550 Fifth Avenue, Suite 1070

San Diego, CA 92103

E: loans@wilshirequinn.com

P: (619) 872-6000

F: (619) 872-6010

Submit a loan application

Partner with a direct lender you can trust.

Customer Service

At Wilshire Quinn you’ll get the friendly guidance you need to help you through the private money loan process. We’ll make sure the loan terms work for you and for your project or we won’t fund the loan. Submit a loan scenario today to quickly hear back from one of our representatives.