Portland

Hard Money Lender

Wilshire Quinn is a Portland hard money lender, financing real estate investments up to $10 million. We work fast, turning loans around much quicker than traditional lending institutions, because we know time is critical for borrowers looking to invest in Portland’s competitive market.

Finance Your Next Transaction With Wilshire Quinn

- A nationwide direct Lender, not a broker

- Pre-approval in 24 hours

- Typical funding in five to seven days

- Loan amounts up to $10 million

Purchase | Refinance | Cash-Out | Rehab | 1031 Exchange

Apply for a Hard Money Loan

Get started by completing the form below and an associate will reach out to get your loan details

To Speak With A Representative

Call (619)872-6000

What is a Hard Money Loan?

A hard money loan is a short-term loan also known as a bridge loan, that is used until a person or company either secures permanent financing or removes the obligation through the sale of the property. Hard money loans generally have higher interest rates than conventional or bank loans, and are written for shorter periods of time. Typical hard money loans or bridge loans are 12 to 18 months in length. Wilshire Quinn loans do not exceed 60% of the appraised value of the property securing the loan.

Who Typically Uses a Hard Money Loan

- Business owners looking to pull cash out of existing properties

- People who want to close quickly

- Borrowers who have multiple properties looking to cross collateralize

- Investors looking to purchase rental properties

- Investors who buy, repair, and immediately resell their property (Flippers)

- Borrowers who cannot refinance with a traditional bank

- Builders and more…

Lending Parameters

| CLOSING TIME | Typically 5 to 7 days |

| LOAN SIZE | $500,000 – $20,000,000 |

| LTV | Up to 60% LTV and 60% of ARV for rehab loans, not to exceed 80% of the purchase price |

| LIEN POSITION | First Trust Deeds Only |

| LOAN TERM | 6-18 months |

| INTEREST RATES | 9% – 12% |

| AMORTIZATION | Interest-only payments |

| ORIGINATION FEES | 1 to 5 points based on location and property, LTV, credit worthiness of the borrower, loan amount and term |

| LENDING AREAS | Nationwide, primarily in metropolitan and coastal areas |

Property Types

- Condominiums

Special Purpose & Mixed Use

Gas Stations

Our Lending Program:

Closing Time: Typically 5 to 7 days

Loan Size: $200,000 to $20,000,000

- LTV: Up to 60% and 60% of ARV for rehab loans, not to exceed 90% of the purchase price

Lien Position: First Trust Deeds

Loan Term: 3 to 24 months

Interest Rate: 7.5% to 11%

Amortization: Interest-only payments

Here’s What Our Borrowers Are Saying

A Proven Portland Hard Money Lender, Lending Nationwide

Portland Hard Money Lender – financing your commercial & residential real estate investments

Portland is the largest city in the U.S. state of Oregon. It is the 26th most populous city in the United States, and the second-most populous in the Pacific Northwest.

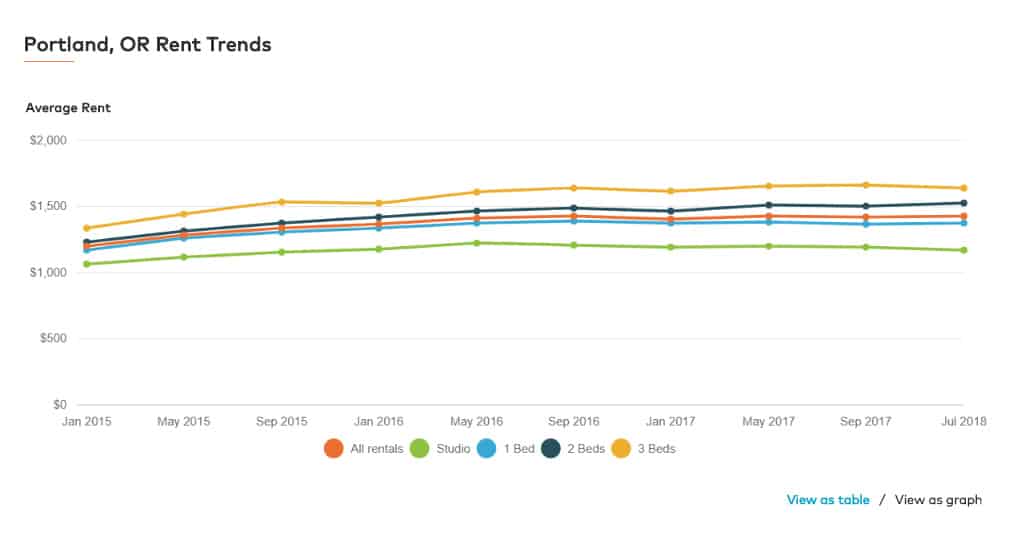

Recent statistics show that investing in Portland real estate might be a safe bet. The economy has steadily bounced back in Portland since the 2008 recession. 60.1% of the population in Portland have white collar jobs and the year-over-year change for rentals in Portland was +2%.

- The majority of Americans rent rather than owning, making purchasing a rental property a good business

- 30% to 40% returns are not unheard of for investment properties

- Portland had the 2nd highest home price growth in 2016 & 2017 (Seattle #1)

- Rent prices increased an average of 8.4% from the previous year

- The average family size in Portland is 2.32

Looking to buy a rental property? Consider working with a Portland Hard Money Lender

The cost of living in Portland has continued to increase over the past 3 years making home ownership difficult for people. Many Americans desire the single-family home lifestyle but just cannot afford to buy into it. Also, Millenials are delaying getting married and have massive school debt, and are not buying real estate. The number of Americans renting is incredibly high, leaving a great investment opportunity in rental income properties.

Rental properties have recently created a stable vehicle for investing money and creating wealth. As many look to purchase an investment rental property, some look for a Portland hard money lender to finance their real estate purchase. Unlike traditional lenders, private money lenders focus more upon on the equity in a property relative to the borrower’s credit score. The underwriting and funding process can take place in a matter of days instead of weeks or months. Wilshire Quinn continues to fund hard money loans in Portland and across the nation.

Asset Based Lending

Asset based lending means we base our loan amounts on the value of real estate, such as an investment property, multifamily building, or commercial building, rather than strictly on your credit score and debt to income levels. Wilshire Quinn takes pride in our common sense equity based lending. Wilshire Quinn is a Portland hard money lender, with experience lending nationwide. As an experienced hard money lender we can handle even the most complicated of lending scenarios and care more about the real estate that you are purchasing or refinancing than inflexible bank requirements.

Submit a loan application

Partner with a direct lender you can trust.

FAQs – Hard Money Loans

A hard money loan is a real estate-backed loan where a borrower receives funds secured by equity in their property (or properties). Hard money lenders like Wilshire Quinn are mainly focused on the equity in the property as opposed to borrower credit and financials. Hard money loans are typically short-term ranging from six months up to two years.

Hard money lenders like Wilshire Quinn primarily focus on a property’s equity to secure the loan. The borrower’s credit is considered, but is not a primary determinant in the underwriting process.

After receiving a signed term sheet, Wilshire Quinn typically funds a loan in five to seven business days.

Wilshire Quinn will consider a wide variety of property types including: office, retail centers, industrial, hotels, parking lots/structures, condo inventory, multifamily properties, non-owner-occupied single-family homes, vacation homes and rentals, primer loans and bridge loans.

We will consider a wide variety of loan types including: purchase, refinance, cash-out refinance, partnership buyouts, rehabs, 1031 exchanges and value-added acquisitions.

You can either complete our online loan application, email or call us. We would prefer to talk through your loan scenario directly, as we can determine in a matter of minutes, once we have a few simple questions answered, if we have interest.

Our interest rates typically range from 9% to 12%, interest-only. Lender origination points typically range from 1% to 5% of the loan amount. The borrower pays for standard closing costs (title, escrow, legal).

Most of our portfolio is in California but we do have the ability to lend nationwide. We strongly prefer to lend in major-metropolitan areas.