Wilshire Quinn Educates Investment Property Buyers on Using Private Money Lending to Win Real Estate Bidding Wars

SAN DIEGO APRIL 24, 2018

Given the intense competition between buyers in today’s real estate market, sellers are increasingly requiring all-cash offers. Obtaining a hard money loan from a private money lending institution can help in this scenario.

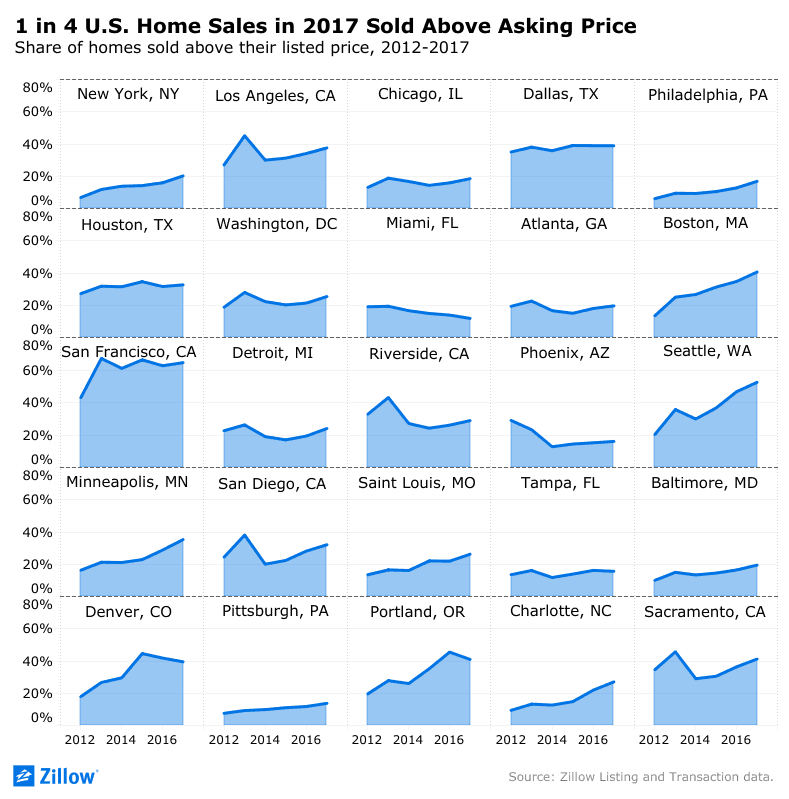

In today’s real estate market, especially in California, there is a great deal of competition between buyers. According to Zillow, nearly 1 in 4, or 24 percent, of U.S. Home Sales in 2017 sold above list price. In California the competition is even more intense: 64 percent of homes in San Francisco, 38 percent in Los Angeles, and 32 percent in San Diego sold above list price.

The cost of paying above listing price for buyers is substantial. Nationwide sellers netted an additional $7,000 on average above listing price. In California, the average selling price above list price was even more severe: $41,000 in San Francisco, $14,100 in Los Angeles, and $5,000 in San Diego.

Given the intense competition between buyers, sellers are increasingly requiring all-cash offers. Furthermore, sellers are also shortening the time to close escrow and are less willing to grant extensions to escrow closing dates. Obtaining a hard money loan from a private money lending institution can help in this scenario.

Unlike traditional lenders, private money lending institutions focus more upon on the equity in a property relative to the borrower’s credit score. The underwriting and funding process can take place in a matter of days instead of weeks or months. Private money lenders typically offer short term or ‘bridge loans‘ (higher interest rate, shorter term, and typically interest-only products) that allow the borrower to tie up the property quickly, and provide them time to apply for longer term financing.

One suggestion to borrowers and brokers that are attempting to purchase a property that is being heavily sought after: ask your private money lender for a pre-approval letter. By showing the seller that you have been pre-approved by a private money lending institution can help you win an offer over another party that does not have financing lined up.

Lastly, when determining which private money lending institution to work with, make sure to ask if the lender is a broker or a direct lender. If you are working with a broker, then you run the risk of the broker not being able to find investors for your deal in time for closing. Working with a direct lender may help you avoid that risk.

Funding in 5-7 days on average

- Loan Amounts from $200,000 to $20,000,000

Commercial & Residential (non-owner occupied) Real Estate

Purchase, Refinance, Rehab, Cashout Refinance, Fix-n-flip, Blanket Loans

Foreign Nationals Okay

Loan Term: 3 – 24 months

About Wilshire Quinn

Wilshire Quinn is a San Diego hard money lender financing commercial and residential real estate loans nationwide. Our highly disciplined and in-house underwriting process allows us to turn loans around quickly, allowing our borrowers to move forward with confidence.

Loans are made or arranged by Wilshire Quinn Income Fund, LLC pursuant to California Finance Lenders Law license #603J060. Wilshire Quinn Capital, Inc. serves as manager of the Wilshire Quinn Income Fund, LLC. The information above is deemed reliable but is not guaranteed. Portions of the loan described above may be sold to third party purchasers and does not necessarily reflect the amount held in the Fund’s loan portfolio. Nothing contained in the information above is an offer or solicitation for the purchase or sale of any security. Any such offer to purchase securities will be made only through the Offering Circular for the Wilshire Quinn Income Fund, LLC.

Recently Funded Hard Money Loans

Submit a loan application

Partner with a Hard Money Lender you can trust.